Starting with the development of a commercial polyhydroxyalkanoate (PHA) product in the 1980s, bioplastics have received off-and-on attention given their potential for widespread application in industry. In particular, it has long been thought that biosynthesized polymers – plastics produced through natural processes, ideally using renewable resources as feedstocks – could be an eventual replacement for traditional petrochemical-based plastics.

In recent years, bioplastics have been thrust squarely into the limelight, due to the world’s worsening plastic-waste problems. There have been some notable wins, from Zymergen’s partnership with Sumitomo Chemical to RWDC Industries’ $133M series B in May 2020. Danimer, a leading bioplastics producer recently valued at $890M, is one of several firms investing heavily in rapidly scaling their manufacturing capabilities. Danimer’s CEO recently explained that “Our big challenge is how quickly we can put capacity on. … Right now, we can sell everything we can make.”

Yet for all the hubbub, bioplastics in 2019 accounted for $8.3B in global revenue, or a scant 1.5% share of the $568.9B worldwide plastics market. Although bioplastics are cost-competitive for a few specific applications, in most cases they are still several-fold more expensive than conventional plastics. Worse, bioplastics took a big hit when the price of oil cratered in 2015 and 2016, which made traditional plastics even cheaper. The effect was severe enough that Metabolix, which in 2016 was one of the world’s largest bioplastics suppliers, sold its biopolymers business, rebranded itself as Yield 10 Biosciences, and pivoted into the crop sciences industry.

And cost isn’t the only challenge to mainstream viability. Despite the marketing hype behind the Pepsi vs Coke "plant bottle" skirmishes, most bioplastics are not (yet) as biodegradable as we might like. Today’s mass-produced bioplastics typically don’t break down very well when buried in landfills; instead, they require expensive, closed-system recycling schemes that are not practical in most contemporary use cases. Some environmental experts have questioned whether bioplastics can play a meaningful role in solving society’s plastic-waste problems.

For all these reasons, most companies in industries that rely on plastics have taken a wait-and-see approach, watching for the moment when bioplastics might actually be ready for prime-time.

Signs of Growth

It turns out the tipping point may be fast approaching. New and promising developments on several fronts suggest that corporate R&D and innovation leaders should pay close attention to bioplastics over the next few years. We see at least three reasons for optimism: a strong base of scientific funding; a mounting pipeline of technology development; and an increasingly robust ecosystem of startups and emerging industrial players.

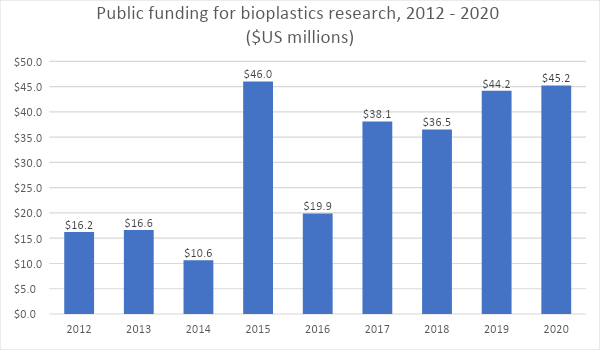

Figure 1: Public funding for bioplastics research, 2012-2020. All figures are in millions of US dollars. Source: Wellspring Scout data.

Figure 1: Public funding for bioplastics research, 2012-2020. All figures are in millions of US dollars. Source: Wellspring Scout data.

Let’s start with the research dollars. The period from 2015 through 2020 represented a step-change increase in public funding for bioplastics research (see Figure 1). Europe and the UK (and to a lesser extent, Canada and the US) have led the way by pouring millions into new research programs. Despite a short-lived downtick in 2016, government appetite for funding bioplastics research has remained strong, with a widening array of governments (most notably, Australia) recently getting in on the act. Here’s a few examples:

- In March 2020, the UK government granted nearly $500,000 to Warwick University for a research effort “to enhance the yields of 2,4- and 2,5-pyridinedicarboxylic acids (PDCA) from lignin, to the point where a commercially feasible method of production could be developed.”

- In November 2019, the EPA granted $300,000 to Texas A&M and industry partner Altex to develop PHA production methods starting from “renewable biomass, such as forest residue, agricultural waste, corn stover etc.”

- In September 2019, the NSF granted nearly $500,000 to the University of Michigan to pursue “a suite of molecular and modeling techniques” in studying methanotrophic bacteria, with the end goal of converting methane gas into bioplastics and biofuels.

- In April 2019, the Canadian government granted $126,000 to McGill University to develop a mixed-microbial process to convert both wastewater and solid waste into PHA in a manner that “will provide cost reduction, and end-product versatility.”

- In January 2019, Finland’s government granted nearly $500,000 to Tampere University to study and optimize the process of microbial electrosynthesis, which converts CO2-rich gases into the building blocks of bioplastics and biofuels.

The EU in particular has used its Horizon 2020 initiative to pursue aggressive investments in bioplastics. Many of these disbursements have focused on accelerating the timeline for launching large-scale, commercially-viable applications into the marketplace, for example:

- Effective April 2021, the EU will invest nearly $3M with a grant to help Danish company Cellugy scale production of its EcoFLEXY product, which is made of nanocellulose that degrades quickly in the natural environment.

- In June 2019, the EU invested nearly $5M in order to help the Belgium-based corporation Sioen Industries, working with a consortium of researchers and startups, “formulate novel PLA copolymers and compounds” that “will be compatible with a broad range of packaging applications’ requirements but also multiple end of life options.”

- In November 2018, the EU invested more than $2M to help Finnish startup Sulapac scale their eponymous product to market, through a process which turns wood-based materials into a range of 100% biodegradable plastics used in “barrier coatings for high volume cosmetic and food industries."

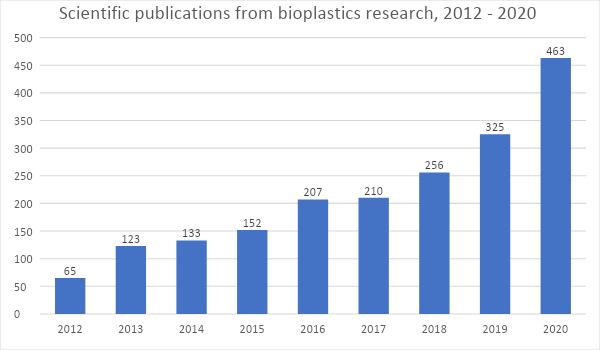

Figure 2: Worldwide bioplastics research, as measured by the count of peer-reviewed journal publications, 2012-2020. Source: Wellspring Scout data.

Figure 2: Worldwide bioplastics research, as measured by the count of peer-reviewed journal publications, 2012-2020. Source: Wellspring Scout data.

The surge in research funding is driving a corresponding increase in scientific output. Bioplastics’ share of peer-reviewed journal publications has risen dramatically over the past few years (see Figure 2). And thanks to a spate of fresh publications in early 2021, bioplastics research output is on pace to shatter its own record from last year. The range and the character of research breakthroughs is deepening and diversifying – everything from discovering new industrial applications, to maximizing production efficiency, to improving biodegradability. Here’s a few recent examples:

- From a collaboration of Danish and Chinese scientists, a February 2021 paper in Carbohydrate Polymers on novel bioplastic synthesis strategies using amylase and cellulose nanofibers to improve properties including crystallinity and permeability.

- From researchers at Washington University in St. Louis, a January 2021 paper in Nanotechnology on nanoscale technologies to increase the efficiency of bacterial bioplastic production.

- From researchers at the University of Tehran, a January 2021 paper in International Journal of Biological Macromolecules on the efficacy of a mucoadhesive bioplastic patch (based on PLA nanofibers) for antimicrobial and wound-healing applications in medicine.

- From researchers at two universities in Thailand, a January 2021 paper in Applied Biochemistry and Biotechnology detailing a novel PHA production method using P. putida bacteria and saponified palm oil.

- From two researchers at the University of Nebraska, a January 2021 paper in Bioprocess and Biosystems Engineering exploring optimal PHB production techniques from biomass (corn fiber) derived sugars.

The third reason for optimism comes from green shoots (no pun intended) sprouting up within industry, especially the startup ecosystem. Today’s startups have gotten much better at taking inefficiencies out of the production process. Many are working on improved and/or customized performance characteristics – effectively broadening the range of industrial applications. Still others are making strides in biodegradability and sustainability. In addition to the companies mentioned earlier, here are a few more examples of emerging players:

- Industrial Microbes – they’ve engineered microbes that produce bioplastics out of industrial-waste greenhouse gases like methane, creating the potential for a significantly “greener” manufacturing process versus relying on crop-based sugars as the feedstock.

- NaturePlast – is a France-based company operating as a private R&D center, developing novel bioplastics for corporate clients “who cannot find any biopolymers that meet their expectations.” The company has been awarded $31.5M in research grants since 2012.

- Green Dot Bioplastics – is a Kansas-based startup specializing in biocomposites, combining bioplastics with wood and starch. They’ve raised nearly $8M in venture funding and their materials are used in everything from surfboards to horticulture to synthetic leather.

- Lignum – is a startup based in South Korea that converts cellulosic biomass into “biofiller” – an upstream material in plastics creation that is designed to make lightweight plastics.

The next few years will be interesting. Although most of the existing bioplastics use cases are in food and beverage packaging, the industry has been pushing into other areas. Plus, the level of investment – and public interest in finding next-gen solutions – has continued its upswing. If you’re a corporate R&D or innovation leader, it’s time to begin investing in your own exploratory supply chain of petrochemical alternatives. Otherwise, you may be forced into following a trail blazed by one of your competitors.

For more insights like this on other trending markets, check out the entire Data Spotlight series.

Image by Rudy and Peter Skitterians from Pixabay