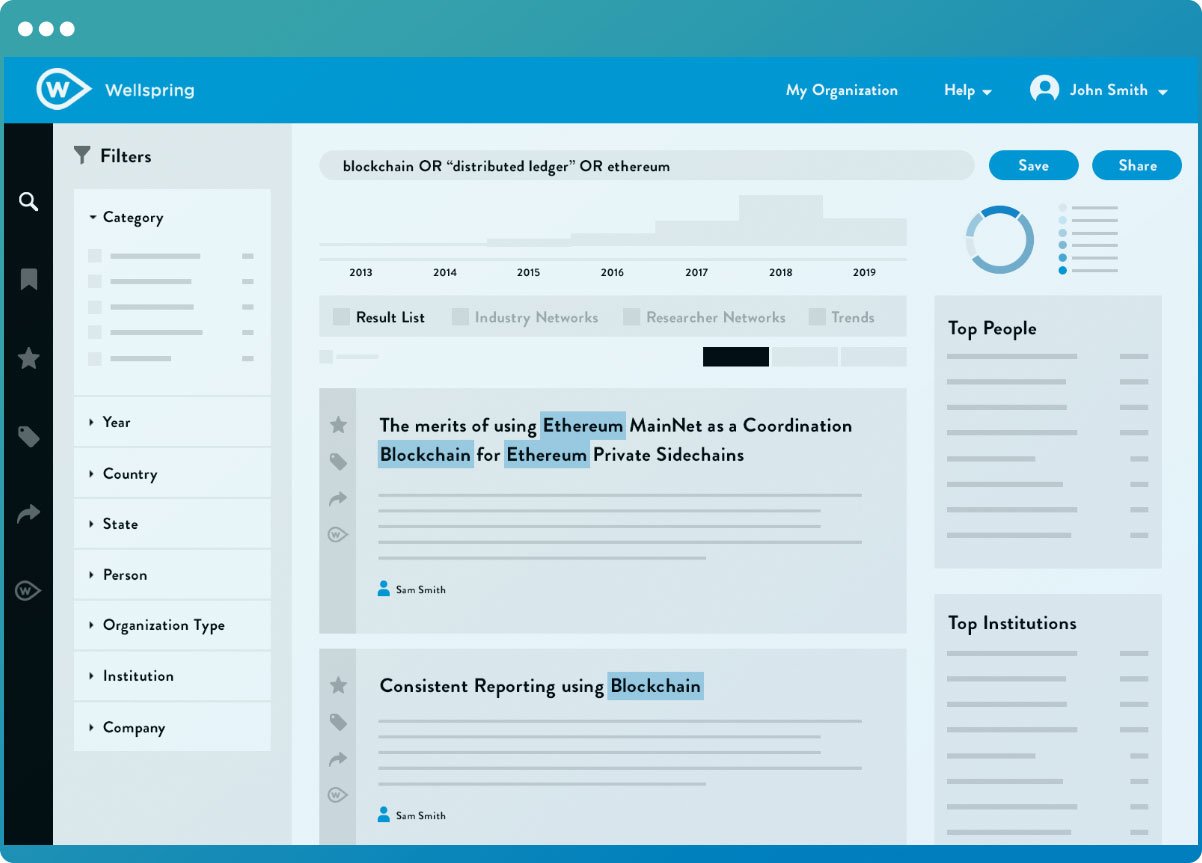

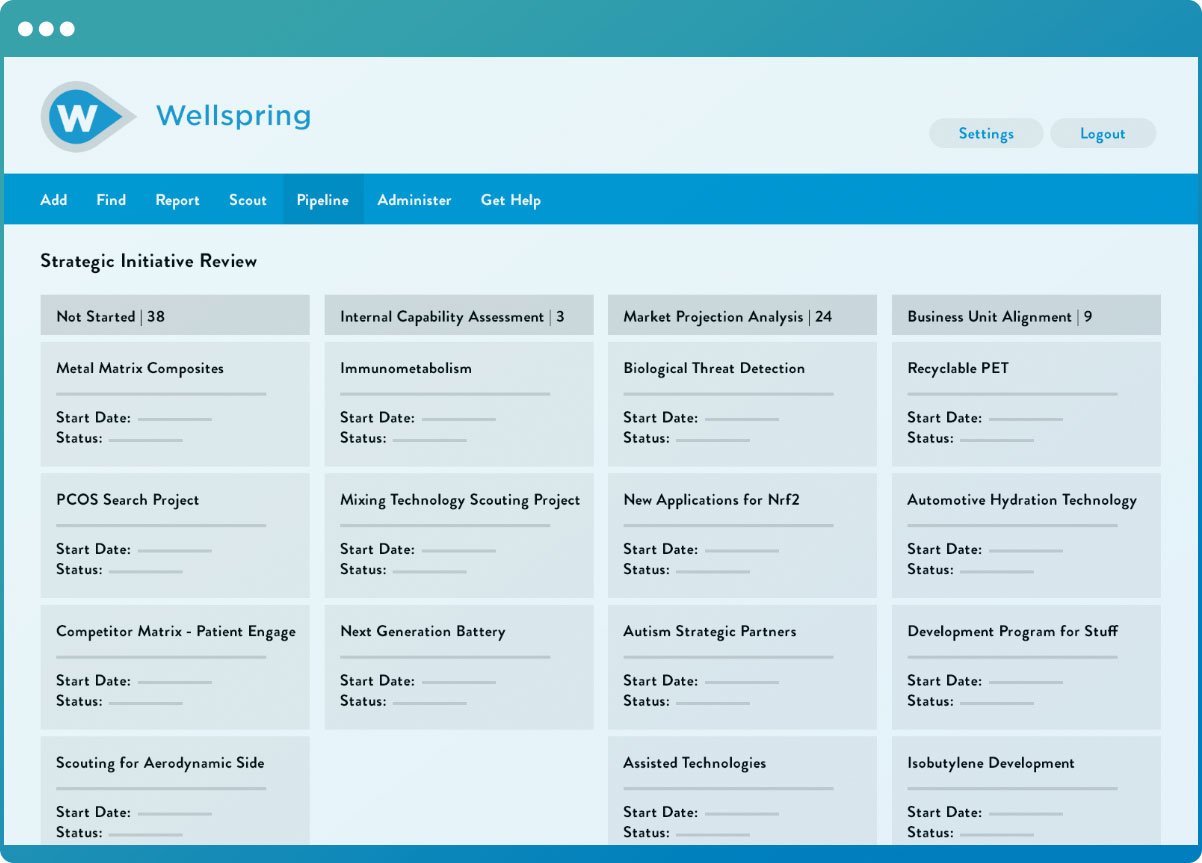

Innovation has never been more important. Yet the levers of success are opaque. How do you coordinate technology partners? Which technologies are in the pipeline? At what development stage? How does knowledge flow through the organization?

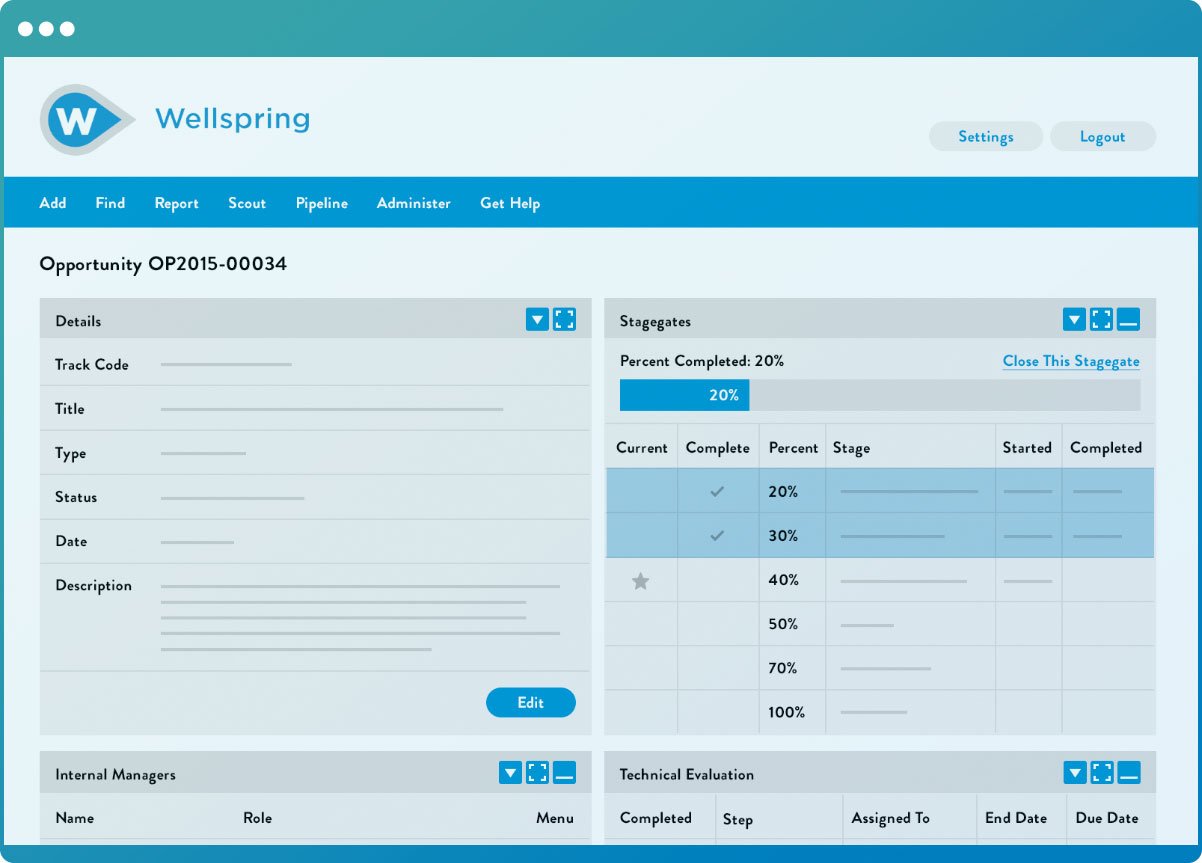

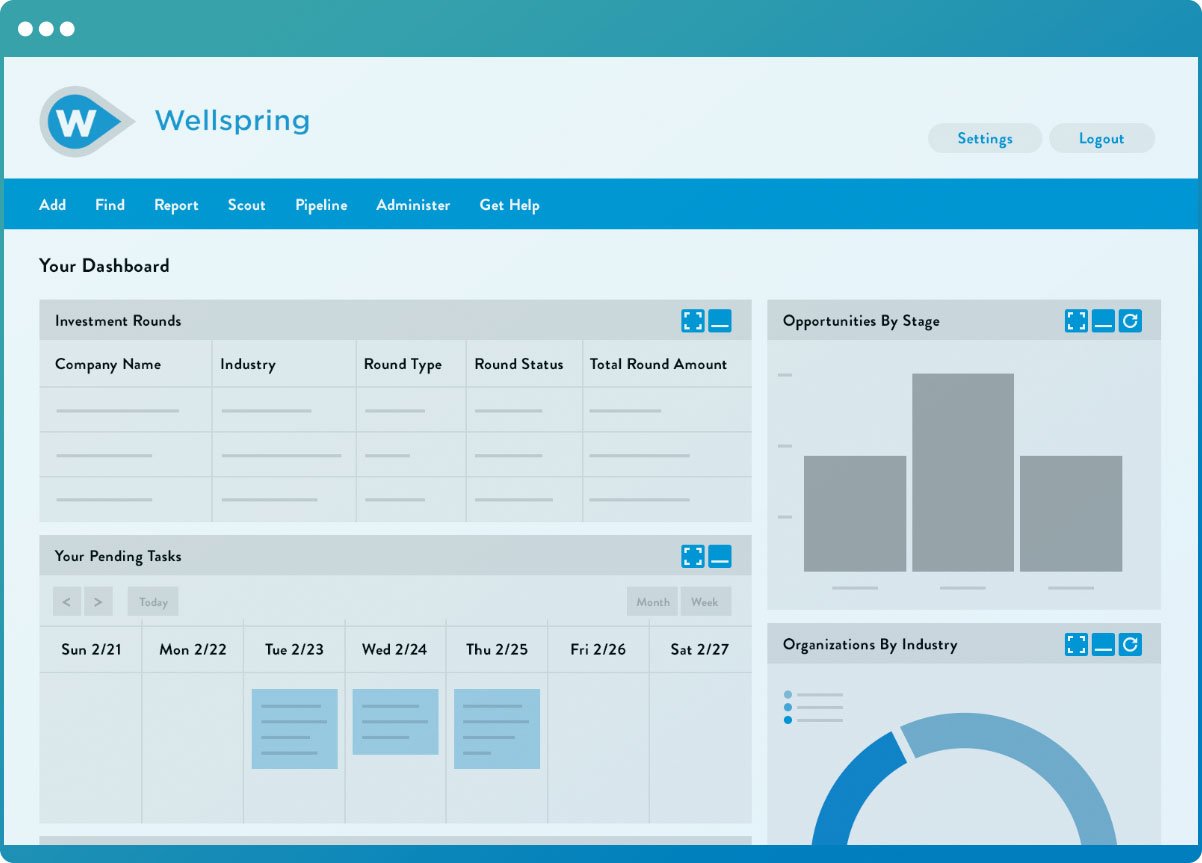

CRM powers sales organizations. PLM supports product groups. Innovation needs an operating system. Purpose-built software brings discipline and clarity. That’s where we come in.